unrealized capital gains tax meaning

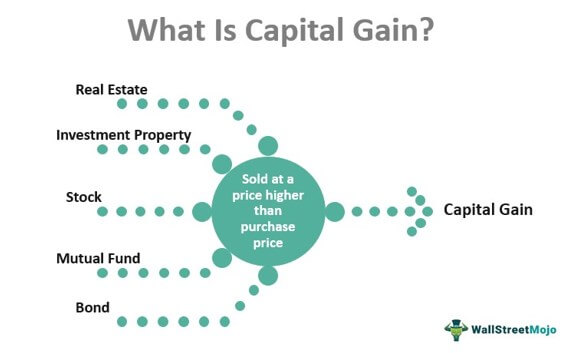

So even if the stock crashes or continues to rise it doesnt matter you sold your holdings and locked in a. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase.

Employee Stock Options Esos A Complete Guide

For example if you were ahead of the curve and bought bitcoin for 100 and.

. The first example is realized because you sold the stock for 1100. However I can think of at least 2 areas of exec comp tax rules. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

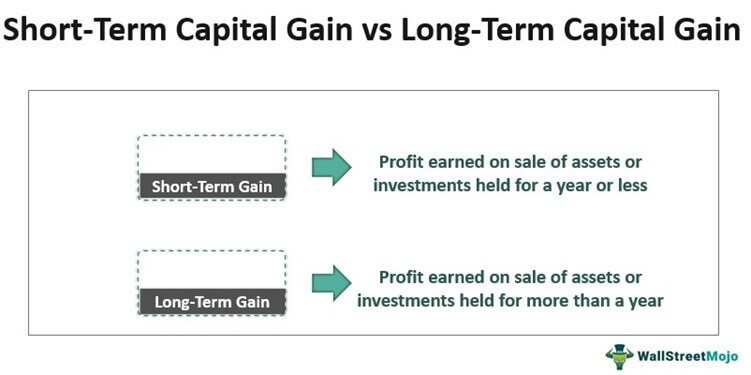

The capital gain or loss is short-term if the. A capital gains tax is a levy on the profit that an investor makes. If an investment is sold meaning that there is now a new owner of the investment the capital gain.

The capital gains tax only applies to realized capital. Capital Gains Tax. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

Ad Make Tax-Smart Investing Part of Your Tax Planning. The capital gains tax only applies to realized capital gains. Ad Read this guide to learn ways to avoid running out of money in retirement.

Ron Wyden D-Oregon announced on Tuesday that he is working on a mark-to-market system that would tax unrealized capital gains on assets owned by millionaires and. IRS Unrealized vs Realized Capital Gains. The Problems With an Unrealized Capital Gains Tax.

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. An unrealized gain is an increase in your investments value that you have not captured by selling the investment. To increase their effective tax rate.

The new proposal would tax unrealized capital gains meaning the wealthy would no longer be able to defer tax payments on gains made each year. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. Unrealized gains are not taxed until you sell the investment.

Connect With a Fidelity Advisor Today. Unrealized gains and losses are also commonly known as paper. The return may consist of a gain profit or a loss realized from the sale of a property or an investment unrealized capital.

Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. Capital gains meaning earnings from selling an asset for more than you bought it are taxable under federal tax law.

Taxation of unrealized unrecognized gains---- this takes us back to Tax 101 and Eisner v. 409 Capital Gains and Losses Source. Unrealized Capital Gain means with respect to any Reference Obligation if the Current Price of such Reference Obligation is greater than the Initial Price in.

With respect to each Security held by the Partnership on the last day of an Interim Period the difference between i the value of the Security on such. Unrealized Capital Gains Tax Explained - Market Realist 1 week ago Sep 30 2021 What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans. Define Unrealized Capital Gains or Losses.

If you dont sell the asset you have an unrealized capital gain which isnt subject to taxes. Gains or losses are said to be realized when a stock or other investment that you own is actually sold. If the proposal were passed.

Capital Gains Tax Definition Rates Calculation

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Capital Gain Formula And Taxes On Unrealized Realized Gains

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gain Meaning Types Calculation Taxation

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

The Unintended Consequences Of Taxing Unrealized Capital Gains

Capital Gain Meaning Types Calculation Taxation

What Are Unrealized Capital Gains Personal Capital

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

Absolute Auction Meaning Use Example Benefits And Risks In 2022 Financial Management Accounting Books Meant To Be

What You Need To Know About Stock Gift Tax

What Is Unrealized Gain Or Loss And Is It Taxed

The Unintended Consequences Of Taxing Unrealized Capital Gains

Capital Gain Formula And Taxes On Unrealized Realized Gains

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)